Sobre nosotros

Inversión responsable

La inversión responsable es fundamental. Por ello, tratamos de integrar los factores ambientales, sociales y de gobierno corporativo (ASG) en nuestro enfoque fundamental de análisis de inversión y administración responsable.

En nuestra opinión, la inversión responsable —respaldada por análisis exhaustivos, titularidad activa y aprendizaje continuo— forma parte integrante del proceso de creación de riqueza a largo plazo.

El análisis en materia de inversión responsable se pone a disposición de todos los gestores de carteras. Algunos equipos pueden otorgar mayor o menor importancia a los factores ASG en su toma de decisiones o no otorgarle importancia alguna.

Capacidades de primer orden

Titularidad activa

Soluciones basadas en productos

Configuración del mercado

Más de 45

ESPECIALISTAS EN ASG

Nuestros expertos en inversión responsable ofrecen apoyo a nuestros clientes y profesionales de inversión y promueven los intereses del sector en general a través de análisis ASG, iniciativas de implicación, voto, datos, informes, desarrollo de productos y filtros para carteras ASG especializadas.

Más de 250

ANALISTAS

Los gestores de carteras, los analistas y los analistas ASG proporcionan un vínculo crucial con el equipo de inversión responsable y llevan a cabo actividades de implicación y análisis específicos en las diferentes clases de activos. Esto nos permite integrar los asuntos ASG importantes desde el punto de vista financiero en nuestro proceso de toma de decisiones.

40 años

DE EXPERIENCIA EN INVERSIÓN RESPONSABLE

Durante más de cuatro décadas, y a través de nuestras sociedades precursoras, nos hemos situado a la vanguardia de la inversión responsable. Nuestro legado en inversión responsable se remonta a la creación del primer fondo europeo con filtros ambientales y sociales, hace ya más de 35 años. Nuestra implicación en materia de cambio climático se inició a través de nuestro servicio reo® en 2000, y fuimos uno de los miembros fundadores de los Principios para la Inversión Responsable de las Naciones Unidas en 2006.

Un centro de excelencia global

Ofrecemos una extensa gama de competencias internas en materia ASG, impulsadas por nuestro equipo dedicado de expertos en inversión responsable.

Una potente combinación que nos permite sacar partido de las mejores ideas de toda nuestra plataforma de inversión para responder a las necesidades de nuestros clientes.

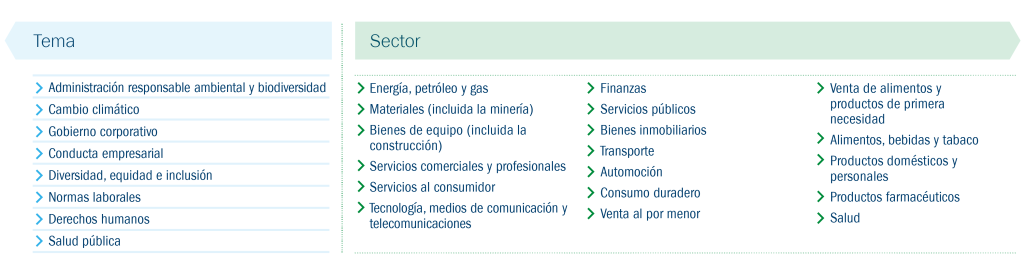

Un amplio abanico sectorial

Nuestros especialistas en inversión responsable atesoran un nutrido repertorio de competencias sectoriales y temáticas que nos permiten desarrollar y respaldar una extensa gama de oportunidades de inversión.

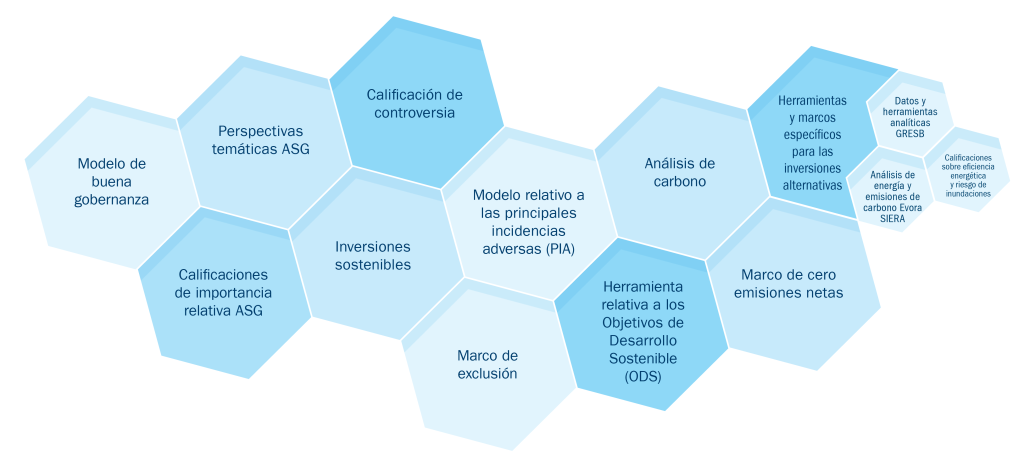

Herramientas y marcos de análisis

Disponemos de una amplia variedad de potentes herramientas y marcos de análisis que constituyen la piedra angular de nuestro proceso de inversión responsable. Estos facilitan la integración de los factores ASG en el análisis de inversión, la construcción de carteras y la gestión del riesgo.

El grado de utilización de estas herramientas depende del mandato del cliente y los objetivos de la estrategia.

Recurrir a una implicación proactiva y al voto por delegación con el fin de maximizar el valor para los inversores

Nuestro extenso equipo de titularidad activa dispone de una gran diversidad de competencias y conocimientos en diferentes sectores y temas de inversión responsable. Los miembros del equipo, en estrecha colaboración con los analistas y los gestores de carteras, investigan asuntos clave y entablan conversación con los responsables de la toma de decisiones a varios niveles de las organizaciones con el fin de comprender la forma en la que se gestionan los factores, los riesgos y las oportunidades en materia ASG.

Énfasis en forjar una relación de confianza

Nuestro enfoque de implicación principal consiste en entablar un diálogo constructivo y confidencial, normalmente interactuando de forma independiente con los responsables clave de la toma de decisiones. Como inversores a largo plazo, valoramos las relaciones de confianza.

También interactuamos con otros inversores, organizaciones no gubernamentales o grupos sectoriales, si ello redunda en el mejor interés económico a largo plazo de nuestros clientes.

Promover cambios positivos a través del voto por delegación

Utilizamos el voto por delegación para alentar a los emisores a que realicen avances o mejoras en temas ASG importantes, así como para fomentar buenas prácticas de gobierno corporativo o mitigación de riesgos. Se trata, en nuestra opinión, de una herramienta efectiva para representar los intereses de nuestros clientes y para garantizar que los emisores no solo toman nota de nuestras inquietudes y preferencias, sino que actúan además en consecuencia.

Actuar para obtener resultados concretos

Establecemos objetivos de implicación claros y viables con el fin de demostrar la importancia que revisten en la creación de valor para los inversores.

Nuestra estrategia de titularidad activa comprende un amplio abanico de riesgos y oportunidades en materia ASG, además de abarcar emisores de diferentes sectores y regiones geográficas.

Nuestras actividades de implicación giran en torno a siete temas de alto nivel que se ajustan a los 17 Objetivos de Desarrollo Sostenible de las Naciones Unidas y las metas subyacentes.

Estrategias de inversión responsable

Los particulares, las instituciones y las compañías de todo el mundo confían en nosotros para que gestionemos su dinero de una forma que permita lograr sus objetivos financieros y, al mismo tiempo, que se ajuste a sus principios y valores. Ahora bien, la estrategia de inversión responsable óptima varía de un inversor a otro.

Durante más de 40 años, hemos demostrado nuestra capacidad para innovar y ofrecer una amplia gama de estrategias de inversión responsable al servicio de nuestros clientes:

Ofrecemos una amplia gama de fondos ASG colectivos que abarcan todas las clases de activos principales, lo que incluye las inversiones multiactivos y alternativas. Sea cual sea su mandato o enfoque de inversión responsable, podemos crear una solución que responda a sus preferencias específicas.

(reo®) – nuestro servicio complementario de implicación responsable

En 2000, nos situamos a la vanguardia en materia de titularidad activa con la creación de nuestro servicio complementario de implicación responsable (reo®), a través del cual los clientes nos encomiendan que nos impliquemos y votemos en su nombre. El servicio reo® permite a los clientes acceder a toda nuestra gama de competencias en administración responsable, lo que incluye:

Informes ajustados a los ODS que describen en detalle el impacto de nuestra implicación

Cobertura intersectorial a escala global en todo el espectro de capitalización de mercado

Más de 20 especialistas en titularidad activa

Un historial de implicación de 23 años

Se ruega tener en cuenta que el servicio (reo®) podría no estar disponible en todas las jurisdicciones.

Apostar por la administración responsable y la responsabilidad global

En nuestra condición de gestora de activos de envergadura mundial, velamos por el buen funcionamiento del sistema financiero. A largo plazo, esto beneficia a nuestros clientes y a la sociedad en general. Nos esforzamos por ser un empleador responsable y por contribuir activamente a favor de las comunidades en las que operamos. Adoptar una actitud responsable representa un elemento fundamental de nuestra cultura.

Participamos en un debate más amplio

Participamos de forma meditada y proactiva en el desarrollo de políticas públicas a través de nuestra implicación con los gobiernos y los reguladores en asuntos importantes, y alzamos nuestra voz como inversores para participar en la definición de las normas. Colaboramos con otros inversores a través de varios grupos de trabajo sectoriales con el fin de comprender mejor los incipientes asuntos ASG y compartir las lecciones aprendidas.

Actuar con un propósito concreto

Desde hace mucho tiempo, adoptamos normas y códigos de inversión responsable reconocidos, y estamos comprometidos a mejorar la diversidad, la equidad y la inclusión en nuestras actividades. También consideramos detenidamente el impacto climático de nuestro negocio y participamos en iniciativas filantrópicas a través de la financiación y el apoyo a organizaciones benéficas. Entre nuestros compromisos corporativos cabe mencionar los siguientes:

Signatario de los códigos de administración responsable del Reino Unido, Taiwán, Japón y Corea

Signatario fundador de los Principios para la Inversión Responsable de las Naciones Unidas

- Signatario de la iniciativa de las gestoras de activos por un mundo de cero emisiones netas (Net Zero Asset Managers Initiative, NZAM)

- Miembro de la iniciativa Acción por el Clima 100+

- Miembro de la Alianza de Inversores por los Derechos Humanos

- Signatario del Grupo de Administración de Inversores (Investor Stewardship Group, ISG) en Estados Unidos, compuesto por inversores y gestores de activos que promueven buenas prácticas de administración responsable y gobierno corporativo

- Signatario fundador de la Carta de Mujeres en el Ámbito de las Finanzas en el Reino Unido

Policies

Disclosures

A

Adverse impact

Aggregate sustainability risk exposure

The overall sustainability risk faced by a company or portfolio, taking account of a range of issues such as climate risk and ESG factors.

B

Best-in-class

Best-in-class strategies try to make their portfolios better on ESG issues and/or carbon characteristics by excluding certain investments deemed negative in that respect or including certain investments deemed positive in that respect.

C

Carbon footprint

The carbon emissions and carbon intensity of a portfolio, compared with its investment universe (benchmark). The benchmark might be, for example, companies in the FTSE 100.

Carbon intensity

A company’s carbon emissions, relative to the size of the business. This allows investors to compare the company’s carbon efficiency with its competitors’.

Climate risk

The risk that an investment’s value could be harmed by climate issues such as global warming, energy transition and climate regulation. Investors normally assess climate risk by looking at carbon footprint data, climate adaptation risk, physical risk and stranded assets.

Climate adaptation risk

See Transition Risk.

Controversies

A company’s operational failures or everyday practices that have severe consequences for workers, customers, shareholders, wider society and the environment. Examples are poor employee relations, human rights abuses, failure to follow regulations, and pollution. Controversies help to indicate the quality of a company.

Corporate governance

The way that companies are organised and led. We look at how well companies are sticking to good practices set out in Corporate Governance Codes, which vary from country to country. Corporate governance is also part of the ‘G’ in ESG. In this context Governance may focus on the operational and management practices relating to social and environment aspects of the business.

Corporate Social Responsibility (CSR)

A company’s approach to (and engagement with) its stakeholders and the communities it operates in, reflecting its responsibility towards people and planet.

D

Decarbonisation

The reduction of the carbon emissions associated with a region, country, industry or organisation. It can also refer to the reduction of the carbon emissions associated with a fund’s investments.

Divestment

The opposite of investment. In other words, either reducing or exiting an investment. We divest if we think the potential risks of investing in a company outweigh the potential returns. This may be because we have lost confidence in a company’s leadership, strategy, practices or prospects .

E

Engagement

Talking to members of the board or management of a company – a two-way process that we might initiate, or the company might initiate. We use engagement to understand companies better. We also use it to give feedback, offer advice and seek changes – including change relating to ESG and climate risk. Engagement also means consulting with government and collaborating with other investors to influence policy and shape debate.

Environmental

The «E» in ESG. This covers a focus on significant environmental risks and their management. In a climate change context it is a focus on the risks associated with a business having to adapt to climate change requirements or the physical impacts of climate change. We also look at companies’ environmental opportunities due to changing consumer demands, policy changes, technology and innovation.

ESG

Short for environmental, social and governance. Investors consider companies’ ESG risks and how well they are managed. To do this, we use the Sustainability Accounting Standards Board (SASB) framework. Considering ESG gives us a different perspective on how good an investment might be.

ESG integration

Always taking account of ESG issues when assessing potential investment opportunities and monitoring the investments in a portfolio.

ESG ratings

Many investment managers use external providers, such as MSCI, to rate companies on their ESG practices. Each provider has its own way of doing things, so ESG scores can vary radically from one provider to another. We run our own ESG system to rate companies. This is based on 77 standards, each for a different industry, produced by the Sustainability Accounting Standards Board.

Ethical investing

An ethical approach excludes investments that conflict with the client values and ethics that a fund is seeking to reflect. There are many different activities or issues that people prioritise as ethical. Common examples include tobacco, adult entertainment, controversial weapons, coal or activities that contravene religious social teaching.

Exclusion

Excluding companies from a portfolio. Exclusions can also be used to set minimum standards or characteristics for inclusion of investments in portfolios. Fund managers may exclude entire industries (e.g. tobacco), companies involved in ethically questionable activities (e.g. gambling), companies that fail to meet certain ESG standards, and companies with a bad carbon intensity.

F

Fundamental analysis/research

Using research to work out the true value of an investment, rather than its current price. Many factors contribute to this, including responsible investment factors. Responsible investment helps us understand the quality of a company, its scope to develop and improve (e.g. in response to climate transition) and its prospects (through making money from responding to sustainability issues). Even if a company is good, it is unlikely to offer good investment returns if this is already reflected in the share price.

G

Green bonds

Debt issued by companies or governments, with the money raised earmarked for green initiatives such as building renewable energy facilities.

Greenwashing

Insincere approaches to climate change and other ESG issues by companies, including investment management firms. For example, an investment manager may label a fund as an ESG fund, even if it does not adopt ESG integration in practice.

I

Impact investing

International Labour Organisation (ILO)

A United Nations agency, often abbreviated to «ILO», that sets international standards for fairness and safety at work. The ILO standards are commonly used by investors to assess how serious a corporate controversy is.

M

Materiality

An ESG issue is «material» if it is likely to have a significant positive or negative effect on a company’s value or performance.

N

Norms-based screening

Screening investments for potential controversies by looking at whether a company follows recognised international standards. We consider standards including the International Labour Organisation standards, the UN Guiding Principles for Business and Human Rights and the UN Global Compact. Specialist RI funds may exclude companies that do not meet these standards.

P

Physical risk

The physical risks of climate change for businesses, such as rising sea levels, water shortages and changing weather patterns.

Portfolio tilts

Investment industry jargon for having more of something in a portfolio than the benchmark, or less of it. In responsible investment it usually means having more companies in a portfolio that have better ESG credentials or are less exposed to climate risk than there is in the benchmark. The tilt is measured as the overall exposure to a specific type of investment in a portfolio compared to that in the benchmark.

Positive inclusion/screening

Seeking companies that have good ESG practices or that help the world economy be more sustainable. Also used as an alternative to «best-in-class«. The opposite of exclusion.

Principles for Responsible Investment

Often shortened to PRI. A voluntary set of six ethical principles that many investment companies have agreed to adopt. Principle 1, for example, is: «We will incorporate ESG issues into investment analysis and decision-making processes.» The PRI was sponsored by the United Nations. Columbia Threadneedle is a founding signatory, and has attained the top A+ headline rating for its overall approach for the sixth year running.

Proxy voting

Voting on behalf of our clients at company general meetings to show support of their practices and approach – or to show our dissent. We put our voting record on our website within seven days of the vote.

R

Responsible Investment (RI)

The umbrella term for our approach towards managing our clients’ money responsibly. This includes the integration of ESG factors, controversies, sustainability opportunities and climate risks into our investment research and engagements with companies, to inform our investment decisions and proxy voting.

Responsible Investment Ratings

Mathematical models created by our responsible investment analysts that provide an evidence-based and forward-looking indication of the quality of a business and its management of risk.

S

SDR (Sustainability Disclosure Requirements)

The Sustainability Disclosure Requirements (SDR) and labelling regime is a UK framework introduced by the Financial Conduct Authority (FCA) to improve transparency and consistency in how investment products and firms disclose sustainability-related information. It is part of the UK’s broader efforts to combat greenwashing (misleading sustainability claims about a product or service) and promote the transition to a greener economy. The SDR regime includes a robust anti-greenwashing rule, sustainability investment labels (to help investors find products that have a specific sustainability goal), as well as comprehensive disclosure rules and naming and marketing rules for retail funds.

SDR - Consumer-facing Disclosure (CFD)

The CFD is an important component of the FCA’s Sustainability Disclosure Requirements (SDR). It is a two-page document designed to help retail investors make informed decisions by providing a clear and concise overview of the sustainable features of funds that use a sustainability label, as well as funds that might not meet the criteria for a label, but nevertheless have certain sustainability-related characteristics.

SDR - Sustainability Focus

The Sustainability Focus Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that invest mainly in assets that focus on sustainability for people or the planet.

SDR - Sustainability Impact

The Sustainability Impact Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that invest mainly in solutions to sustainability problems, with an aim to achieve a positive impact for people or the planet.

SDR - Sustainability Improvers

The Sustainability Improvers Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that may not invest in assets that are sustainable now, but which aim to improve their sustainability for people or the planet over time.

SDR - Sustainability Mixed Goals

The Sustainability Mixed Goals Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that invest mainly in a mix of assets that either focus on sustainability, aim to improve their sustainability over time, or aim to achieve a positive impact for people or the planet.

Scope 1, 2 and 3 emissions

The building blocks used to measure the carbon emissions and carbon intensity of a company. Under an international framework called the Greenhouse Gas Protocol these are divided into Scope 1, 2 and 3 emissions. Scope 1 emissions are generated directly by the business (e.g. its facilities and vehicles). Scope 2 covers emissions caused by something a company uses (e.g. electricity). Scope 3 is the least reliable because it is the hardest to measure. It covers other indirect emissions generated by the products it produces (e.g. from people driving the cars a company makes).

Screened funds

Funds that use screens to exclude companies that do not meet their ethical criteria, ESG expectations, carbon intensity or controversy standards.

Social

The «S» in ESG. Investors analyse social risks and how these are managed. This includes a company’s treatment of its employees and its human rights record for other people outside the company (e.g. in the supply chain). It also refers to a company’s commercial opportunities in responding to changing consumer demands, policy changes or technology and innovation (e.g housing, education or healthcare).

Social bonds

Bonds issued to raise money for a socially useful purpose, such as education or affordable housing. Social bonds follow the standards set by the International Capital Market Association (ICMA) and appoint independent external reviewers to confirm the money raised will be used appropriately.

Socially Responsible Investing (SRI)

A form of ethical investment that attaches particular importance to avoiding harm to people or the planet, from the investments being made.

Stewardship

A catch-all term to describe the actions taken to look after our clients’ money. It commonly involves both engagement with companies, to develop a proper understanding of business developments, issues and potential concerns; and proxy voting to support or oppose issues at company general meetings.

Stranded assets

A variety of factors can lead to the risk of assets becoming stranded, such as new regulations or taxes (e.g. carbon taxes or changes in emission trading schemes) or changes in demand (e.g. impacts on fossil fuels, resulting from the shift towards renewable energy). Stranded assets risk having their value written down, impacting the value they have in a company’s accounts.

Sub-advisor

When one investment management company hires another investment management company to manage one of their funds, the hired company is the sub-advisor. Sub-advisors are sometimes used in responsible investment if they have specialist knowledge of this field that does not exist in-house.

Sustainability Accounting Standards Board

Often referred to as «SASB», this is a non-profit organisation that sets standards for the sustainability information companies should communicate to their investors. It has produced 77 sets of industry-specific global standards. SASB looks for sustainability issues that are financially significant to a particular industry.

Sustainability risk

An environmental, social or governance risk that could hit the value of an investment.

Sustainable Development Goals (SDGs)

A set of 17 policy goals set out by the United Nations, which aim for prosperity for all without harming people and the planet. Each goal has a number of targets. For example, Goal 2 is Zero Hunger and Target 2.3 is to double the productivity and incomes of small-scale food producers. Companies can contribute to the SDGs by making products or services that help achieve at least one of the 17 goals.

Sustainable investing

Investing in a way that recognises the need for and supports balanced social, environmental and economic development for the long term.

T

Task Force on Climate-related Financial Disclosures (TCFD)

The Task Force on Climate-Related Financial Disclosures was set up by the World Bank to help companies communicate their climate risks and opportunities and how they manage them. The TFCD sets out a framework for communicating how management considers climate risks, its strategy for responding to climate change, risk management arrangements and the types of risk covered. The TCFD says companies should, for example, explain how their business strategies would cope in different temperature scenarios. From 2022 companies listed on the UK stock market will have to follow the TCFD’s recommendations for disclosing climate risks.

EU SFDR (Sustainable Finance Disclosure Regulation)

This forces funds to communicate how they integrate sustainability risk and consider adverse impacts. For funds promoting environmental or social characteristics or that are targeting sustainability objectives, additional information will need to be communicated.

The EU Taxonomy

Often called the «Green Taxonomy». This is the EU’s system for deciding whether an investment is sustainable. Investments must contribute to one or more environmental objectives and meet the detailed criteria required for each activity or product that contributes to this. Investments must not do significant harm to any of the objectives. They must also meet minimum standards in business practices, labour standards, human rights, and governance.

Thematic investing

Researching global trends, or «themes», to identify investments that will either benefit from changing needs or be impacted by them. Common themes are climate change and technological innovation. Often combined with sustainable investing, which looks at these trends but with an additional focus on the environmental or social implications of themes.

Transition risk

The potential risks faced by companies as society transitions towards alignment with the Paris Agreement to limit global warming. This is the risk that a company is so invested in certain incompatible operations and assets that it is uneconomical to transition to align with the Paris Agreement.

U

UN Global Compact (UNGC)

The world’s largest sustainability initiative. The UNGC sets out a framework based on Ten Principles for business strategies, policies and practices, designed to make businesses behave responsibly and with moral integrity. Companies can volunteer to sign the Compact, and can be struck off by the UN for breaking it. The Compact is commonly used by investors to assess how serious controversies are.

UN Guiding Principles for Business and Human Rights

A framework for companies to prevent human rights abuses caused by their activities. Commonly used by investors to assess the severity of companies’ human rights failures.

IA ávida de energía: repercusiones para la inversión en laera de la transición energética

Los cambios demográficos son el futuro y los inversores deben prepararse

Comicios en Estados Unidos: la Ley sobre Reducciónde la Inflación y el riesgo de que se derogue

Información importante

Con fines publicitarios. Su capital está sujeto a riesgos. Columbia Threadneedle Investments es la marca global del grupo de sociedades Columbia y Threadneedle. No todas las entidades del grupo ofrecen todos los servicios, los productos y las estrategias. Los premios o las calificaciones pueden no ser aplicables a todas las entidades del grupo.

Este material no debe considerarse una oferta, invitación, asesoramiento o recomendación de inversión. Esta comunicación es válida en la fecha de publicación y puede sufrir cambios sin previo aviso. La información obtenida de fuentes externas se considera fiable, si bien no puede garantizarse su precisión o integridad. Los parámetros de inversión reales son acordados y expuestos en el folleto o contrato formal de gestión de inversión.

En el EEE: Publicado por Threadneedle Management Luxembourg S.A., sociedad inscrita en el Registro Mercantil de Luxemburgo (R.C.S.) con el número B 110242, y/o Columbia Threadneedle Netherlands B.V., entidad regulada por la Autoridad Neerlandesa de los Mercados Financieros (AFM), registrada con el número 08068841.